Accenture found that unless traditional insurers invest in new digitized distribution models that drive customer engagement and value, 25% of their profit could be at risk from fast-moving digital-first insurers.

Perhaps traditional insurers are slower to react due to legacy systems or established processes. But even if that’s the case, they need to adapt to the customer journey people go on today. While a sector like insurance will likely need to have agents and representatives for their customers or prospects to talk with, there’s also room to embrace new technologies, such as gamification, to attract, engage, and retain customers.

What is gamification?

According to Wikipedia, gamification is the strategic attempt to enhance systems, services, organizations, and activities by creating similar experiences to those experienced when playing games to motivate and engage users.

Gamification is exciting because it promises to make the hard stuff in life fun. Many industries realize that gamification is not a passing fad but a valuable trend that is here to stay.

What is the role of gamification in insurance?

Gamification can be leveraged across the insurance value chain – from policy distribution to post-sales service. It can benefit all stakeholders involved, such as risk carriers, intermediaries, and, most importantly, customers.

How does the psychology of gamification influence customers?

Insurance companies must understand how and why gamification can influence emotions and behavior.

Psychologists identify two types of motivation: intrinsic and extrinsic.

- Intrinsic motivation occurs when we perform an activity for our internal satisfaction and internal rewards rather than material rewards.

- Extrinsic motivation happens when we complete a task based on external causes, such as avoiding punishment or receiving a reward.

While extrinsic motivation is helpful in the short term, intrinsic motivation produces more lasting results.

Customers intrinsically motivated through personalized gamification strategies and promotions are more likely to have long-term loyalty and customer satisfaction. This is because intrinsic motivation goes beyond points and badges; it drives a person to act for the challenge or even fun of it.

How can gamification in insurance drive higher sales conversion and increase sales productivity and revenue?

Customers perceive insurance as a complex product with a tiresome purchase process. Most insurers, especially those in developed markets, follow a business model that utilizes insurance agents to overcome this. Traditionally, agents have been pivotal in educating customers on the insurance products available to them. However, digitalization has enabled customers a more significant role in selecting the right product, and gamification can play a crucial role in customer engagement. The insurance sales process typically includes search, quote generation, and sales closure.

1. Stand out from the crowd.

With 68% of insurance consumers not having any particular insurer in mind, personalized gamified promotions and strategies can help insurers stand out from their competitors.

2. Create awareness through education.

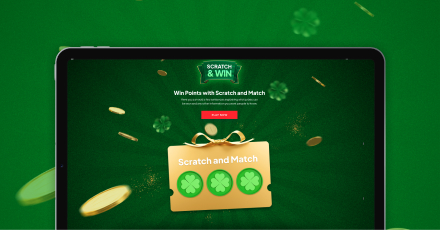

Insurers can develop and deploy games that provide customers with information about the different insurance plans available. This way, prospective customers can get all the information they need to make reasonably informed decisions. When educating through gamification, insurers can move away from a single reward system to a game-based benefit system that allows customers to earn rewards in stages.

3. Motivate and reward learning

Rewards should be tangible and relevant to the customer. Provided they are within regulations, gamified rewards can translate to better offers and discount vouchers. Insurers can also track the customers and cross-sell and upsell based on relevance. They can reward customers with perks for referring others to play the games, thereby educating more people on their insurance products.

3. Know your customers and reduce acquisition costs

With Insurance keywords costing $50 or more per click, paid search competition is fierce. By rewarding customers for their valuable data, you can identify your most engaged and best prospects, re-target them better, and ultimately reduce your acquisition costs.

4. Increase sales close rates.

A sale is only considered closed when the policy is issued. A customer or broker has to submit a proposal form and any necessary supporting documents to the insurer. As this can seem tedious, many people need more motivation to complete the process. Gamification can make this process exciting and compelling. An insurer can divide the information-capturing process into stages and provide mini rewards at the end of each stage. Incentivizing each stage will get more sales over the line and ultimately increase close rates.

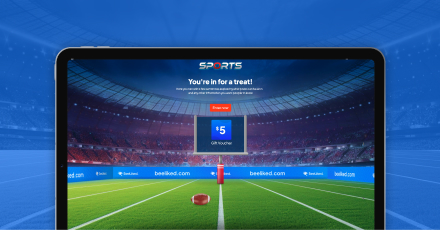

“BeeLiked has allowed us to create a unique broker reward experience that would not have been possible without gamification. We have seen around a 20% increase in broker-driven policy binds in just under a year.”

Jenny Hammond | Director of Marketing and Communications | SIS Insure

What does this mean for insurers and agents?

It is time for insurers to understand that gamification can enable agents to open doors to many experiences that customers need and, most importantly, offer the platform to stay engaged. Insurers can leverage gamification to augment the role of the insurance agent and motivate brokers. Gamification can also help agents address customers’ core needs, create more opportunities for self-service and cross-selling, and increase awareness about insurance products.

About BeeLiked

A good business is only as good as its sales. The BeeLiked gamification platform allows companies to motivate and reward their sales teams, partners, and customers with personalized promotions that drive productivity and business success.